Unlock Your SaaS Cash Flow By Taking These 5 Simple Steps

Accounting profit is great, but cash pays your bills. For ISV’s, maximizing cash flow with your customer’s money helps you grow quickly with less outside capital.

Here are 5 easy (and mostly free) ways to help your business improve cash flow almost overnight.

Taking these steps at TaskRay in 60 days we saw:

- +50% decline in DSO’s

- 44% decline in Accounts Receivable balances.

- +100% increase in cash balance

How’d we do it? Let’s dive in.

Default Payment Terms

The power of defaults is underrated. Many times, folks often accept defaults without question. People typically only have capacity to fight so many battles on a given day, so negotiating deal terms someone doesn’t believe is material may not be worth the fight.

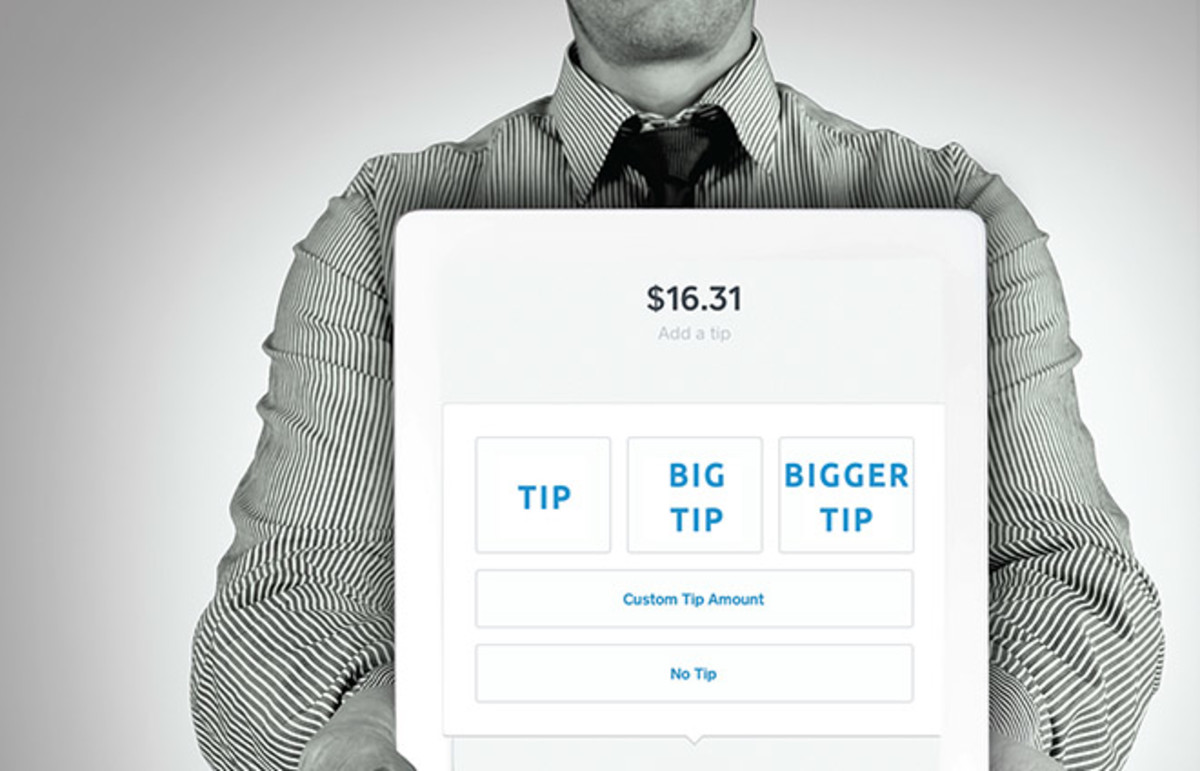

In fact, we see the power of defaults have in our daily lives. With the proliferation of digital payment solutions in physical and online stores and their default tip options, tipping at quick service restaurants has increased 16.7%. Since credit and debit card tipping has been offered at Starbucks, they found over 50% of transactions now include gratuity.

Defaults are indeed powerful and using them to your advantage can improve your cash flow. One painless way to improve your cash flow is to change your default payment terms from standard Net 30 to Due on Receipt or Net 7.

Ultimately, you might end up back at the standard Net 30 or whatever your customer dictates (particularly for Fortune 50), but your default terms can be an extra negotiating lever and you might get a deal concession somewhere else.

Automate Invoice Reminders

The longer an invoice is past due, the more likely the balance is written off or written down.

Collecting quickly, particularly when enthusiasm for your product is likely highest, maximizes cash flow from your invoices. Setting up automated invoice reminders is a must-do action.

If you don’t have invoice reminders set up, change your settings as soon as possible. You might be spending more time on collections and customer follow up than needed and your time is better spent on other value added activities.

QuickBooks Online, Xero, Freshbooks, Netsuite, and other accounting software have out-of-the-box offerings that remind your customers of their outstanding invoices. There are other accounts receivable automation platforms like Bill.com, Invoice Sherpa, InvoiceApp, and other platforms that do a nice job and integrate with most.

To further improve your cash flow, consider creating customer reminder notifications indicating an upcoming invoice is due X days in the future.

While you are setting up your invoice reminders, consider setting a dollar threshold on the reminders to avoid a bad customer experience by continually sending customers past due reminders over trivial amounts.

Accept Credit Card Payments

Yes, credit card fees are annoying. They can be costly too, but pay the fee. The fees are worth it and will result in quicker cash flow and fewer write-downs.

In most organizations, there are more employees with access to company credit cards than access to company’s other payment methods. Payments made by check, ACH, wire are made in timed batches and often require multiple steps with several gatekeepers along the way. In other words, non-credit card payments usually have embedded friction and each point of friction impacts your cash flow.

By accepting credit cards, you both eliminate friction and expand the number of people within the organization that can pay your invoice.

Get rid of friction whenever and wherever your can! Don’t ask yourself the cost of fees, try to figure out the cost of not paying the fees.

Review Outstanding Invoices Weekly

A great habit to have is to review your outstanding invoices weekly with your sales and account management teams. The meeting both helps you keep track of outstanding invoices and likelihood of receipt of payment

The conversation often becomes an invitation to review your customers’ journey with the product and whether there is a reason they have not paid their invoice. Sometimes delay or refusal to make a payment is a sign of trouble with a customer and represents a potential opportunity to save a customer from churning.

You might also consider having the customer’s point of contact being whoever has the warmest relationship with the customer rather than a faceless accountant.

Email Your Customer Directly (Old School)

Many email spam filters will move invoice email and reminders into your Junk folder. In most cases, customers are not paying your invoice because they are not seeing it.

To avoid that problem and get a customer to pay, you can instruct the customer to change their email filter settings (mixed results whether they take action) or you can send them an old fashioned email. I saw the responsiveness on past due emails increase over 40% by taking a simple step: adding icons and emojis in the subject line.

Old Subject Line: Past Due Invoice: 7 days past due

New Subject Line: 🔴 Past Due Invoice: 7 days past due 🔴

When Businesses Thrive or Die

The top cause of businesses dying is running out of cash. As paradoxical as it sounds, too much success can kill a business as much as not having enough demand for a company’s products.

When businesses scale and expand quickly and sell lots of product, they often have front-loaded capital requirements to procure the goods they are selling, pay out commissions to salespeople, and scale up hiring enough customer service resources, and many more potential uses of cash. This phenomenon is particularly true in the physical world where businesses frequently need to procure product prior to delivery and payment from a customer and more so for companies without a long history or with vendors unwilling to extend terms.

By maximizing cash flow, a business has more oxygen and a better chance of weather unexpected success or slow sales periods. And this lesson holds true equally for companies with limited cash flow and rapidly expanding enterprises.

Wrapping Up

Maximizing cash flow is often a priority of companies. There are a number of free or inexpensive methods you can implement to almost immediately generate more cash from existing and new customers. By focusing on changing internal processes, habits, and contracts for new and/or renewing customers, you can see significant improvements in your cash flow for little or no cost.

If you don’t know where to start, Sanitas Accounting can help. Reach out and we’d be happy to help with strategy and implementation on improving your cash flow.